|

Brief Description

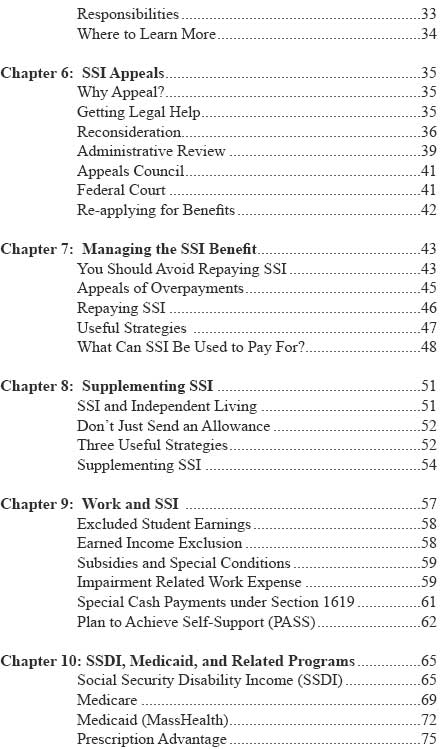

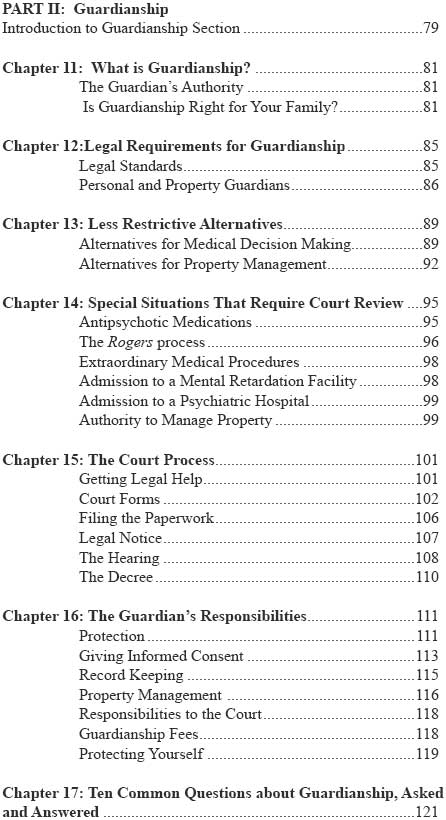

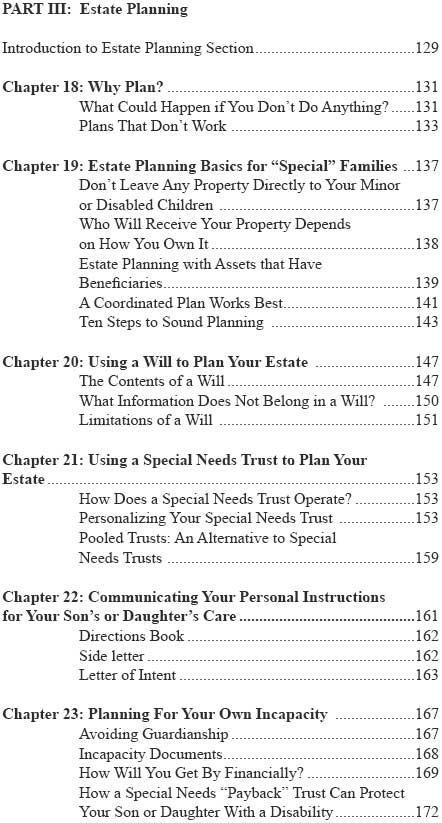

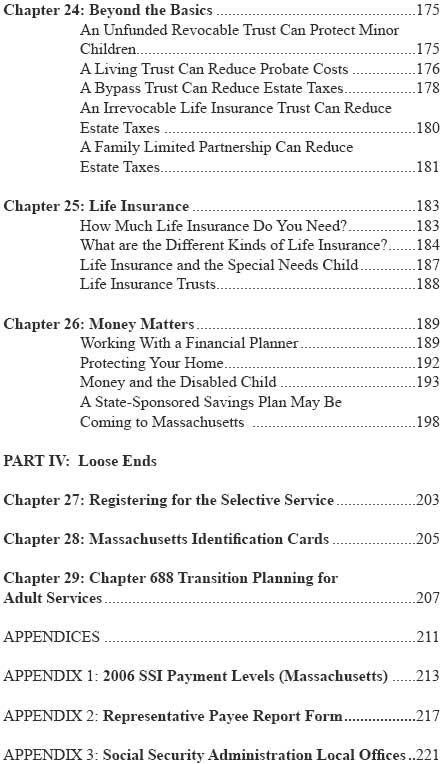

~ Summary ~ Table of Contents

~ Excerpts ~ Published

Reviews ~ Reader

Reviews ~ Meet the Author ~

Book Home

Page

Brief Description Attorney Barbara Jackins' new book is a must have resource for parents of children with special needs and the professionals and advocates who assist parents. In an easy-to-read, conversational style, she covers the essential elements of SSI, guardianship, and estate planning when there is a child with a disability in the family. Although some of the materials are specific to Massachusetts, most of the strategies she discusses are valid in any state. Don't live in Massachusetts? Then you can simply ignore the fine points about that state's guardianship laws and procedures. The rest of the book--her practical estate planning strategies and SSI pointers-- will get you on track no matter where you live.

In a relaxed, conversational style, Attorney Barbara D. Jackins explains the essential elements of SSI, guardianship, and estate planning when there is a child with a disability in the family. You will find the information you need to:

From the Foreword by Theresa M. Varnet, J.D., ACSW Like Barbara, I am the parent of a young adult challenged with developmental disabilities…Her…book is easy to read, thorough, and comprehensive.

Barbara reviews several important topics: how to save money for your child’s future in a way that will not jeopardize government benefits, and why it is so important for your child to have a guardian, an agent under a durable power of attorney, or other personal representative to help your child negotiate the system after he or she reaches adulthood at age eighteen. She also does an excellent job in helping families better understand the SSI and SSDI programs. These two programs can be quite intimidating. Barbara explains the differences between these two benefit programs, including the eligibility requirements, the application process, and the appeals rules. Both SSI and SSDI can play a crucial role in our children’s future, and every advocate needs to thoroughly understand these programs. Legal Planning for Special Needs is an excellent planning guide. Parents of children with special needs and the individuals we hope will look out for and advocate for our children when we are no longer able to care and advocate for them will benefit by having this book at hand.

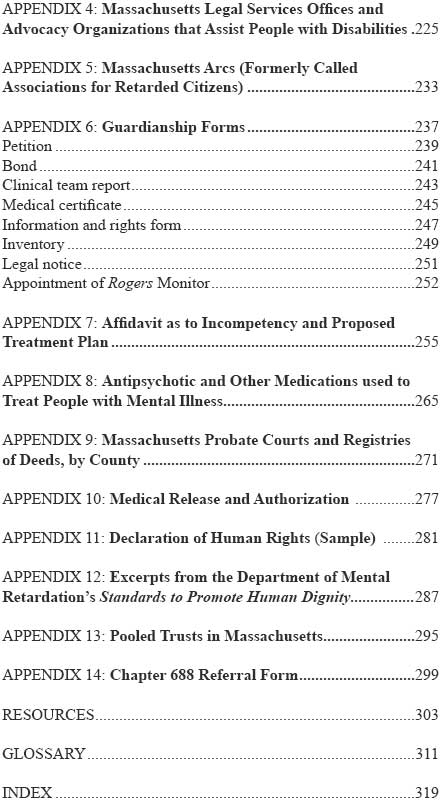

THIS BOOK IS FOR PARENTS of children with special needs. It is intended to explain in practical terms how you can develop a sound plan for your son’s or daughter’s future. It doesn’t matter how old your son or daughter is. He or she could be a young child, getting ready to graduate from special education, or settling into a comfortable middle age. When you have a child with a disability, you can’t leave things to chance. There is too much at stake. Believe me, I know. I have had a disability-related law practice for over 25 years. During that time, I have seen first hand how the failure to adequately plan can cause unnecessary cost, anxiety, and delay. I first became interested in planning issues many years ago. That was when my son, who has developmental disabilities, was a young child. Like many parents in my situation, I quickly became immersed in the world of disabilities. As time went on—as happens with many parents—my personal circumstances came to influence the kind of work I chose to do. Eventually my law practice became almost completely centered areas of the law that are important to families like ours: disability, public benefits, and estate planning. This Legal Planning for Special Needs book represents what I have learned in over 25 years of practicing law. Why SSI, guardianship, and estate planning? Because those areas of the law concern almost every family that has a child with special needs and can benefit from advance planning. Take SSI, a common government benefit program. Most of our sons and daughters will first qualify for SSI benefits at age eighteen. But if they have more than $2,000 in assets, they cannot get benefits. And with birthday checks, gift savings bonds, and our own diligent savings efforts, it doesn’t take much to put them over the $2,000 limit. Thus, you must start planning early to find the proper ways to save money so that your son or daughter will not lose any benefits when he or she reaches age eighteen. Guardianship is another area that can benefit from advance planning. Guardianship is not necessarily appropriate for every family. However, if you do decide to seek guardianship, you should have the legal authority in place on or shortly before your son’s or daughter’s eighteenth birthday. That way, you will be able to act immediately if there is an emergency. Estate planning is another important area. Almost every family can benefit from having an estate plan. Having a proper plan in place can help assure a son’s or daughter’s financial security when we are no longer here. How is this book organized? The book is divided into four parts. Part I covers SSI. It includes the program basics, how to apply, and how to manage the SSI benefits after the checks begin to arrive. Part II covers guardianship. It addresses the decision to seek guardianship, how to get appointed, and the guardian’s responsibilities. The Massachusetts probate court procedures are also explained in detail. Part III covers estate planning. There is information about wills, the special needs trust, and other important estate planning documents. I also explain the right way—and the wrong way—to save money for your son or daughter with a disability. Part IV ties up some loose ends: registration for the Selective Service, Massachusetts identifications cards, and the Chapter 688 transition process. There are also Appendices, a Glossary, and a Resources section. I also want to explain what this Legal Planning for Special Needs book is not. It is not intended to be a substitute for the services of qualified professionals. Rather, it is meant to be a guide to working with professionals such as attorneys, financial advisors, accountants, and tax consultants. Also, I don’t attempt to address every conceivable situation that can arise. All families are unique, and different circumstances require different approaches. Another point: the laws and procedures in this area are quite complicated. Questions are bound to arise, and you will probably need qualified professionals to answer some of them. But don’t just hire anyone. Make sure the person is knowledgeable about special needs and experienced in working with families like ours. How can you find a qualified professional? Start by asking your family and friends. Perhaps they may have worked with someone they can recommend. The Arcs (formerly called Associations for Retarded Citizens) and other organizations that assist families can be another good referral source. There are also some suggestions in the Resource section. A last point: this book explains the current laws and procedures. Of course, those laws and procedures may change over time. I will update this book periodically to reflect those changes. Another way for you to stay on top of new developments is to attend some of the informative workshops sponsored by the Arcs and other organizations that assist people with disabilities. You can find an Arc in your area by contacting the Arc of the United States (www.thearc.org, telephone 301-565-3842). Also, the Resources section contains a list of Arcs and other advocacy organizations that assist families. I hope the information in this book is useful to you. If you have any questions about what you have read, don’t hesitate to seek the advice of a qualified attorney. You can benefit from developing a relationship with someone who can assist you and your family. After all, there is no substitute for sound personal legal advice.

“This book is a “must have” reference manual for all parents who have children, teens, and adults with Asperger Syndrome.” Dania Jekel, Executive Director, Aspergers Association of New England “This easy-to-read guide answers the questions you didn’t know you needed to ask.” Susan Nadworny, Chairperson, Families Organizing for Change “The author’s expertise, empathy, and easy writing style all combine to create the relaxed intimacy of a conversation over coffee with a very good, knowledgeable friend.” Carol Beard, member, DMR Citizen Advisory Board,

“This comprehensive guide is an amazing resource. You are going to see this book on the shelf of every professional advocate in the state.” Jerry Silbert, Autism Society of America National

Board Email your review to reviews@disabilitiesbooks.com Barbara D. Jackins practices law in Belmont, Massachusetts.

Her practice centers on areas of the law that affect people with

disabilities and their families, such as estate planning, Medicaid

planning, government benefits, guardianship, and trust administration.

She has served on the Governor’s Commission on Mental Retardation:

Task Force on Public-Private Partnerships. She currently serves

on the Board of Directors of the NWW Committee for Community Living,

Inc., located in Newton, Massachusetts, a non-profit agency that

provides community housing to individuals with developmental disabilities.

She is a member of the National Academy of Elder Law Attorneys and

a 1978 graduate of Suffolk Law School. In 2005, she co-autored The

Special Needs Trust Administration Manual: A Guide for Trustees

(DisABILITIESBOOKS, Inc.). She is married to Attorney John L. Mason,

Jr. and is the parent of an adult son with developmental disabilities.

|